Around 80% of Americans have some sort of debt. This means that chances are, you’re one of them and you’re looking for ways to manage your money better.

One way to do so is to balance your books and figure out a budget from there. But this isn’t easy to do unless you have prior pay stubs on hand.

If you don’t, not all hope is lost. With the convenience of the internet, making your own pay stubs is just a click away.

If you’re wondering how to make a pay stub, then you’re in the right place. In this article, we’ll teach you how to create a pay stub, as well as give you a few scenarios where this may be handy.

How to Make a Pay Stub

An easy way to make a pay stub is to use a free pay stub generator. All you need to do is enter how you’re paid (salaried vs hourly), employment status (employee vs contractor), and the state you work in.

This will then take you to a screen where you can enter your company information. It may be a good idea to gather all your work information beforehand, as it’ll make the process of creating a pay stub much smoother and quicker.

After entering the company information, you’ll need to enter your own information, which is the “employee information” section. You’ll need to have the last 4 digits of your SSN handy.

The next screen will be your salary information. Here, you can indicate your status (hourly vs salary), then you can input your annual salary amount, as well as your pay frequency.

Once you’ve filled out all this information, you can then give the pay stub creator site your email address. You can then preview your pay stub and have it sent to the email address you’ve provided.

When You Can Use a Self-Generated Pay Stub

Of course, you can use a self-generated pay stub to balance your books and create an effective budget. But these pay stubs can do much more than that. Here are some great scenarios where you can put these to use.

Proof of Evidence as a Self-Employed Person

Let’s say you’re about to rent an apartment, take out an auto loan, or apply for a mortgage. These are huge milestones, which means it won’t be easy getting money from a provider. They’ll want to see that you have a steady source of income.

When you have an employer, it’ll be easy to show the evidence they need. You’ll just have to hand over the pay stubs they’ve given you, or you can submit the W-2s you’ve received from your employer over the years.

But when you’re self-employed, you won’t have these steady pay stubs. You’ll most likely have to file a 1099-MISC form, but that may not be enough to show proof of evidence.

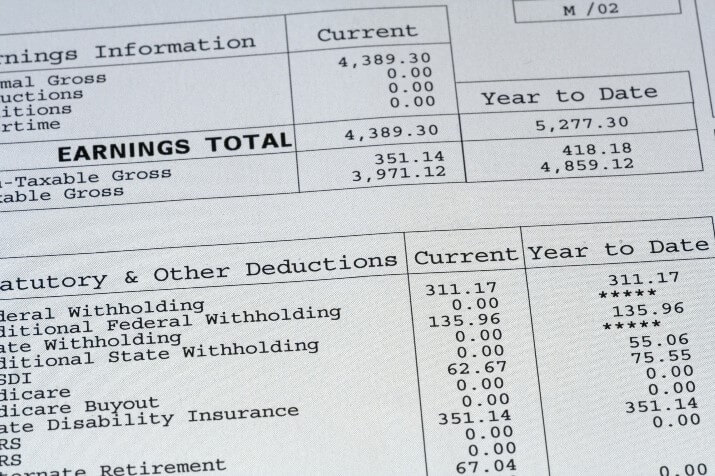

You can always show your bank statements, which will display all the payments your clients have made over a certain period of time. But you can also generate pay stubs. With these, you can show any deductions you had to make.

Pay stubs will be easier to show proof of income when compared to bank statements, as you’ll be able to provide straightforward statements that show your income. With bank statements, you’ll have to sift through all the transactions, which can be tedious and eat up a lot of your valuable time.

Use as Electronic Records Instead of Paper

They say that you should keep your physical pay stubs around for at least 1 year before throwing them out. That way, you can compare them to your bank deposits and income tax statements to see if there are any discrepancies.

But once you throw them out, it may be hard to get that information back without a bunch of work involved. On the other hand, if you decide to keep years and years of physical pay stubs, that can quickly take up a lot of room.

What you can do is go online and enter all the information from these pay stubs into a creator. To avoid a pileup of work, you should do it as you receive each paycheck.

Once you’ve created an online pay stub, you can throw the physical one away after a year. You’ll have electronic records of your income for the rest of your life if you download these files and store them safely.

Keep Better Employee Records

If you’re a small business owner, you may have trouble keeping track of employee records. Thankfully, pay stub creators are here to help.

Not only do they have the ability to create pay stubs within minutes, but many also have the capability to generate W-2 forms. Just like with the pay stub creation process, all you have to do is fill out a few fields, and you’re done with just a couple clicks.

This can help you out immensely without the need to buy expensive software.

Create a Pay Stub Today

As you can see, learning how to make a pay stub is very easy, so long as you have all the necessary information at hand.

Whether you want to balance your books or provide evidence of income to a lender or landlord, it’ll be very easy to create your own pay stubs. By learning this valuable skill, you’ll open windows of opportunities you previously didn’t have.

Did you enjoy this article on how to make a pay stub online? Then please make sure to check out our other helpful blog posts!

Thanks for sharing this amazing information with us I am so greatful